European exporters compared in the 2023 pre-consensus

Italian exporting companies face a certainly complex international scenario, but they can enjoy some 'structural' strengths

Published by Marzia Moccia. .

Europe Conjuncture Export Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

The publication of ExportPlanning preestimates for the current year, accessible through the Ulisse Datamart, allow for a comparison of the performance of the The Old Continent's major exporters, against an international backdrop marked by the significant slowdown in global demand and the effects of restrictive monetary policies deployed by major central banks to counter more persistent inflation than initially assumed.

The slowdown, however, is the result of highly differentiated dynamics on the commodity and geographic fronts, and in this sense it seems particularly useful to investigate the international positioning of the major European exporters, which reflects the relative specialization and competitiveness factors of the major EU countries.

The post-Covid recovery

From a medium-term perspective, the scenario in which we stand is that of a post-Covid recovery that has had different intensities for the main European exporters (Fig.1). In particular, it seems quite evident that the performance of Italy and Spain has largely outperformed that of Germany and France. It is precisely France that seems to be the member state that experienced the largest fall in the pandemic year, compared with a gradual recovery over the following years.

Fig.1 – Export of goods: Germany, Italy, France and Spain

(index 2019=100)

Source: ExportPlanning

Although in a context of a general and significant slowdown, the 2023 pre-stimate also confirms a good resilience of Italian exports in the current year: based on currently available data, it is estimated that the Belpaese export will close the year with an overall change of 1.3 percent, when the Spanish competitor is expected to experience a weak decrease, amounting to -0.6 percent.

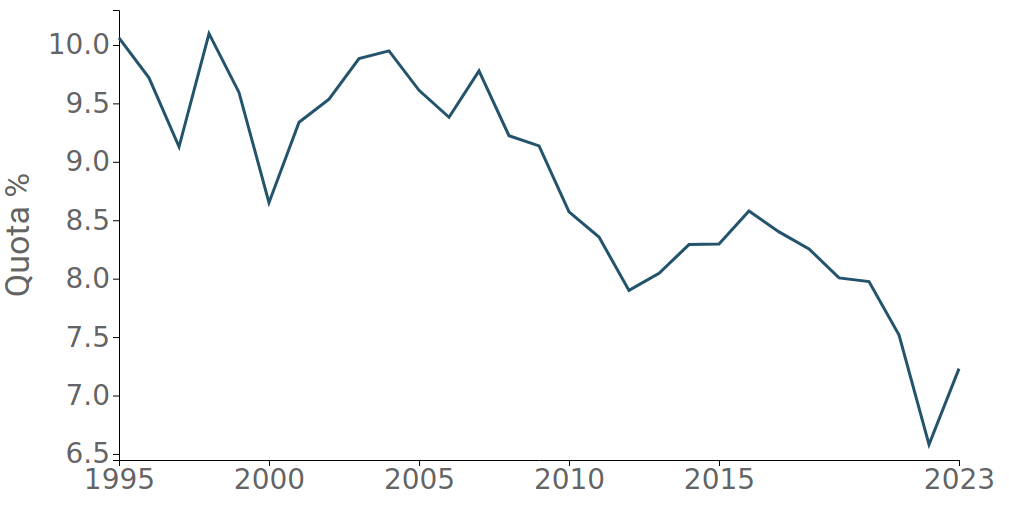

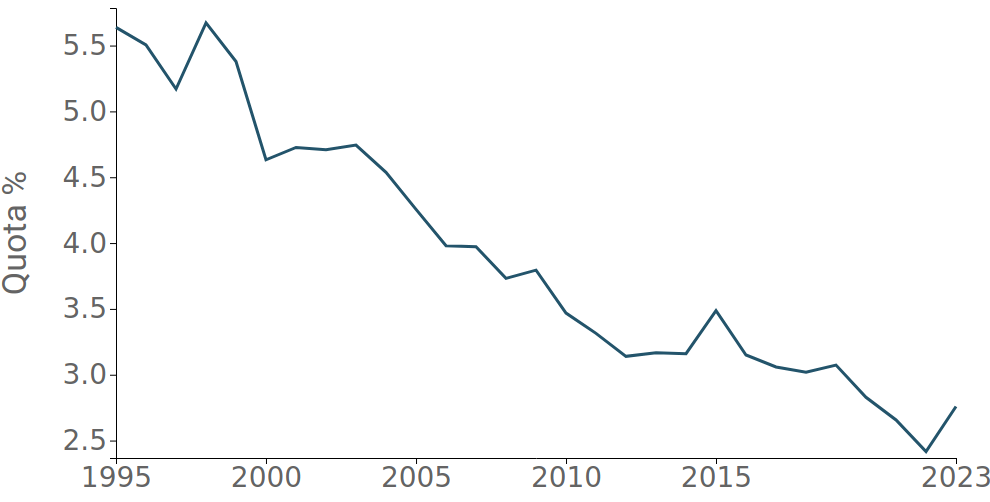

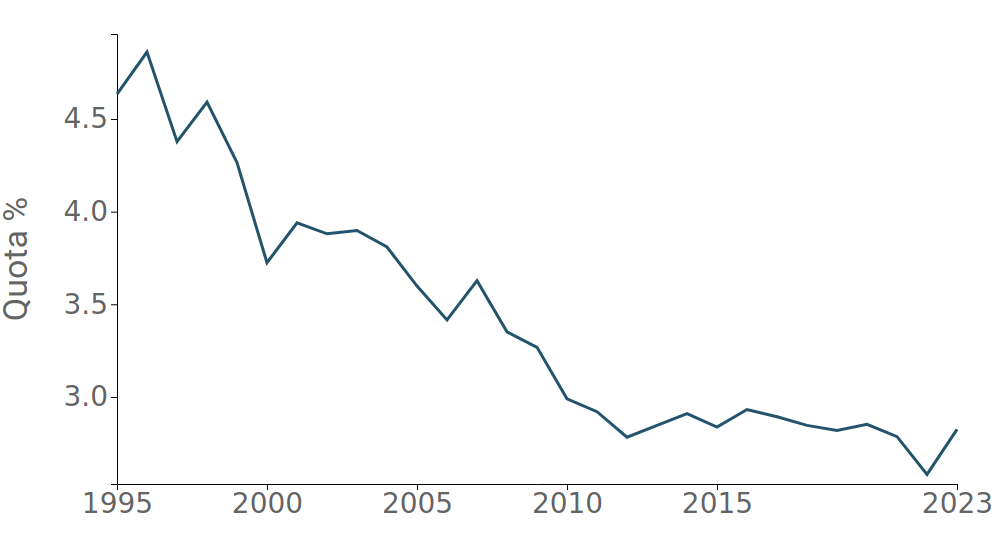

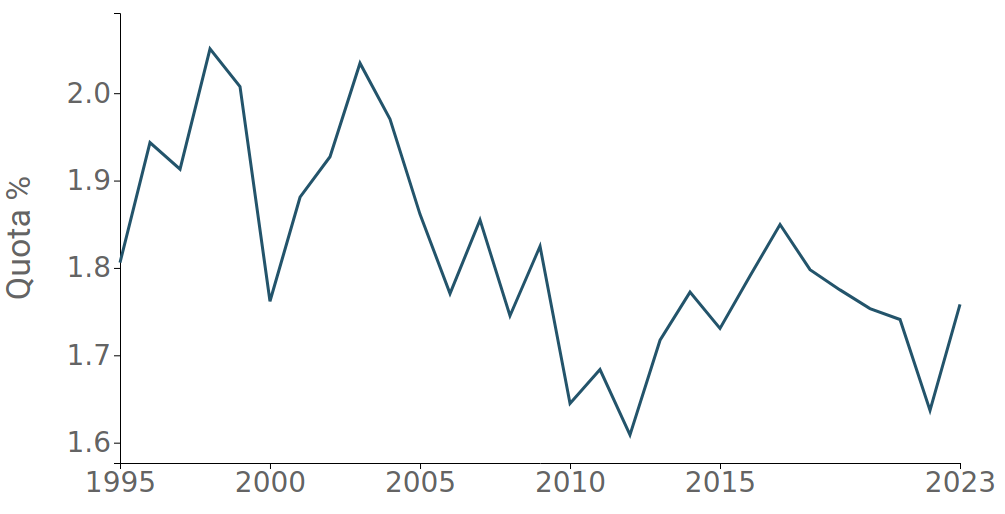

The signs of resilience of Italian exports are further confirmed by the dynamics of the world trade shares held by the four European exporters, shown in the following graphs.

Fig.2 – Evolution of market shares of major European exporters

(processing in value)

Source: ExportPlanning

The substantial resilience of Italy's share of world trade from 2012 onward appears to be a "unicum" on the scene of major European exporters.

From a long-term perspective, the process of weakening of the share of world trade recorded over the century is evident, which only in the Italian case seems to have reached its stabilization. Particularly significant is the downsizing triggered at the dawn of the pandemic year in the cases of France and Germany, which seem to have found only in 2023 a weak reversal, which in any case has not allowed them to recover what they left on the ground during the previous years. More variable is Spain's share of world trade, which nevertheless in the medium-period appears to be in relative decline. Substantially, when compared to the pre-covid figure, only Italy defends its 3% share.

Several commentators have wondered about possible explanations for the responsiveness and resilience of Italian exports evidenced over the past few years.

Of note is the recent paper published by the Bank of Italy, in which the authors traced this phenomenon to three main factors:

- the improvement in the price competitiveness of the Belpaese export, such that half of the competitive gain would be due to the modest dynamics of producer prices compared to those of competitors;

- the lesser impact on Italian companies of critical supply issues and "bottlenecks" in international supplies;

- the lower exposure of Italian exports to energy intensive sectors, which are particularly affected by rising commodity prices, and which seems to have affected the German competitor more.

In conclusion, Italian exporting companies are facing a certainly complex international scenario, but they can enjoy some "structural" strengths that have been consolidated over the past few years. A competitive improvement that has allowed a better performance than the average of the main European countries in the period 2019-2022 and that could find further growth cues in the near future, if properly accompanied by a planned approach to international markets.