III quarter 2023: world trade conjuncture

The ExportPlanning pre-stimate for the third quarter of 2023 shows a picture economy that is still struggling

Published by Simone Zambelli. .

Conjuncture Global demand Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

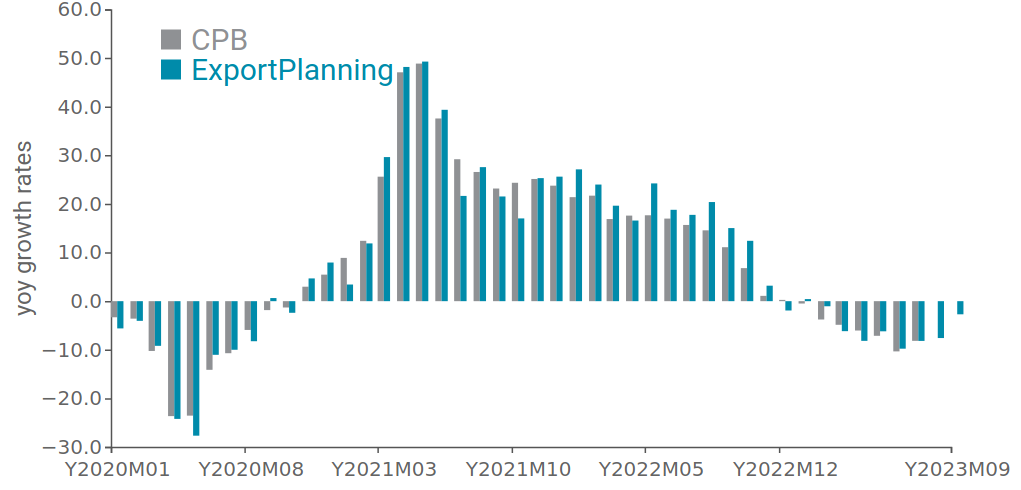

The availability of ExportPlanning pre-estimates for the third quarter of 2023 -accessible through the datamart World Conjuncture- provides an overview of the economic situation of world trade, which has been characterized by a slowdown for several months now. In fact, the beginning of 2023 proved to be particularly negative, as shown in Fig.1, in which monthly quarterly changes in current dollar prices are shown, comparing data compiled by ExportPlanning with those of the Central Planning Bureau, an institute that collects and processes information on international trade in goods.

Fig.1 - Global demand in dollars

(CPB data vs. ExportPlanning data, trend change)

Source: ExportPlanning.

It is evident that both measures reported are very similar to each other, certifying the robustness of the phenomena at work: since the last months of 2022, world demand for goods has shown substantial weakness that has gradually intensified during 2023.

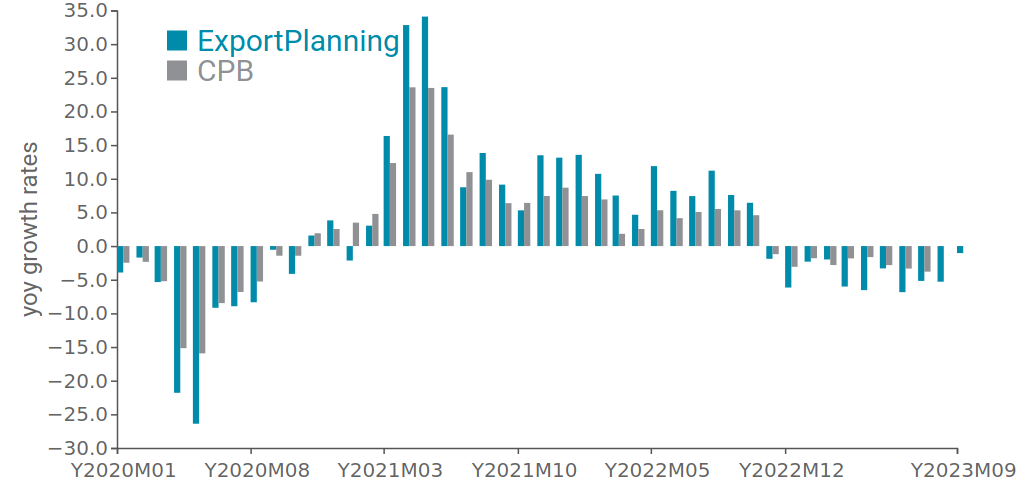

However, to get a clearer view of the economic dynamics, it is appropriate to consider values at constant prices, i.e., stripped of price and exchange rate dynamics, which have been the protagonists of important and significant changes in more recent times. In fact, analyzing the dynamics of world trade in goods makes it possible to evaluate phenomena in real terms, that is, in quantity.

Fig.2 - Global demand in quantity

(CPB data vs. ExportPlanning data, trend change)

Source: ExportPlanning.

The dynamics in constant prices provide robust documentation of the slowdown phase that is characterizing world demand: overall, it recorded a 3.6 percent drop in the first quarter compared to the same period in 2022, which was followed by a further 5.6 percent contraction in the March-June period and a 3.8 percent drop in the June-September period. The downturn phase that followed a two-year period of sustained trade growth thus appears evident.

The slowdown in global demand for goods reflects the sharp contraction in industrial activity levels on a global scale, as gleaned from the Manufacturing Purchasing Managers Index (PMI), which gives us a snapshot of the manufacturing industry using data collected from surveys of corporate purchasing managers. The PMI thus represents market "sentiment."

Fig.3 - Global manufacturing PMI and New Export Orders

(the line in gray signals the neutrality threshold of 50)

Source: ExportPlanning.

Since the fourth quarter of 2022, the index has fallen below the critical threshold of 50, indicating expectations of shrinking activity levels. Particularly significant is the New Export Orders component of the Global Manufacturing PMI, a leading indicator of the dynamics of global trade in manufactured goods. The indicator has been in negative territory now since late 2022, yet it does not appear to be intensifying its fall over the past few months.

The cyclical state of global demand for goods appears weak, as outlined by the analysis just conducted. The international scenario appears fragile and is affected by the aftermath of the Russian-Ukrainian conflict and the effects of inflation-containing monetary policies.

In addition, economic dynamics suggest a picture of the slowdown with differentiated impact in geographic and sectoral terms, which makes monitoring available information a key strategic lever for businesses.