World trade slows, but not for Italian companies

In post-pandemic recovery, Italy along with Spain leads EU export growth

Published by Giulio Corazza. .

Europe Global economic trends

Log in to use the pretty print function and embed function.

Aren't you signed up yet?

signup!

In these early months of 2023, the international economic picture still remains critical. Uncertainty related to the war in Ukraine, persistent inflation and the resulting restrictive policies implemented by central banks to combat it have led to a slowdown in world trade in the fourth quarter of 2022. The overall picture in Europe is not the best. Some countries, however, are going through this slowdown better than others.

In this situation, it may be useful to delve into the dynamics of Italian exports, comparing them to the average performance of other European exporters.

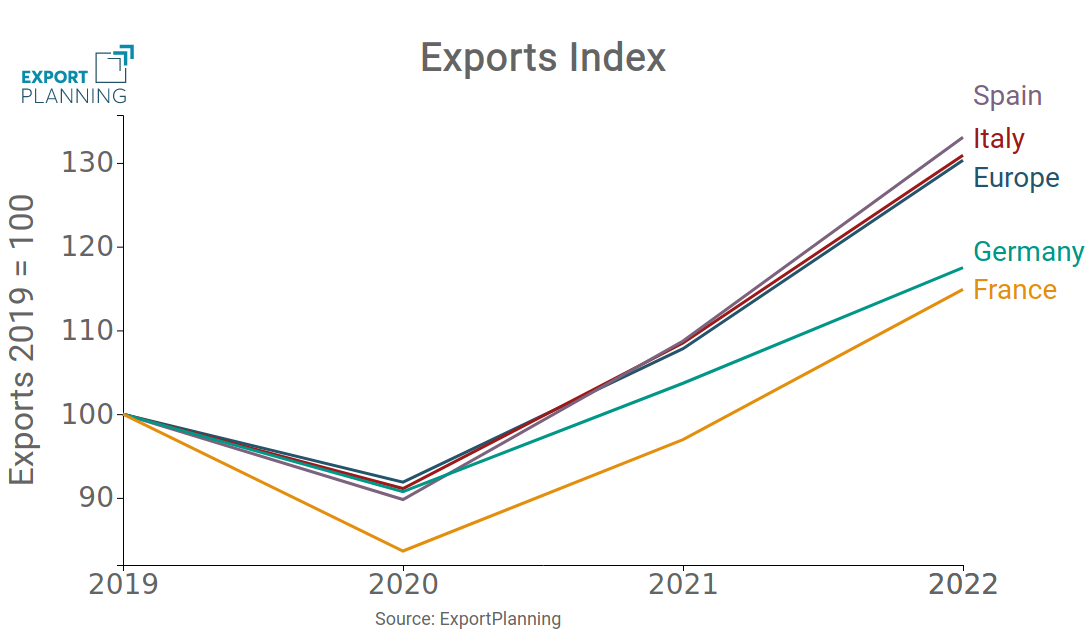

The following graph shows the annual dynamics of exports for Italy, Germany, France, Spain and the Europe aggregate, measured in index with base 2019=100.

After the 2020 covid-19 outbreak that also brought trade to its knees, exports of European countries resumed a growth path and today have fully recovered the levels of that year. Some countries like Spain and Italy have led this recovery, while others like France and Germany have struggled more, ranking below the European average.

Fig.1 Export Index

The resilience of Italian industry

The following graph shows the rate of change of exports in 2022 at the European level and the top 50 sectors by level of Italian exports. Ball sizes are proportional to export values in 2022.

Fig.2 - Sectoral rate of change 2022, Italy vs. Europe

By hovering the mouse over the circle that identifies a sector, a table summarizing the data for the selected sector can be displayed

Source: ExportPlanning

The best result is found in health products and instruments. In particular in the pharmaceutical sector (E4.11), whose Italian exports in 2022 grew more than twice the European average. Italy is a leading country in the production of drugs in Europe and this is a very positive result, the result of investments made by companies in the sector.

Two other sectors stand out for their positive results in 2022: they are Telecommunication Equipment (F1.42) and Ships and Pleasure Craft (F3.23). Researching the factors behind this success will have to be the subject of a subsequent in-depth study.

The sector with the highest growth rates in 2022 in both EU and Italian exports is the Petroleum Products sector, whose value exports have been supported by the strong increase in prices.

We find it useful to point out the two Italian sectors that performed particularly below the EU average in 2022: Organic Basic Chemicals (A2.22) and Automotive (F3.11). As for the Automotive results, they confirm the greatest difficulties encountered by the Italian sector. Conversely, the less brilliant performance of Italian Basic Chemicals can be traced to the higher energy costs, compared to other European competitors, that have burdened the Italian industry.

A comparison with Spain

As the first graph showed, Italy and Spain are two success stories that deviate positively from the European average. Spain performed better than Italy in 2022. One factor behind this result could be derived from the cost advantages of electricity.

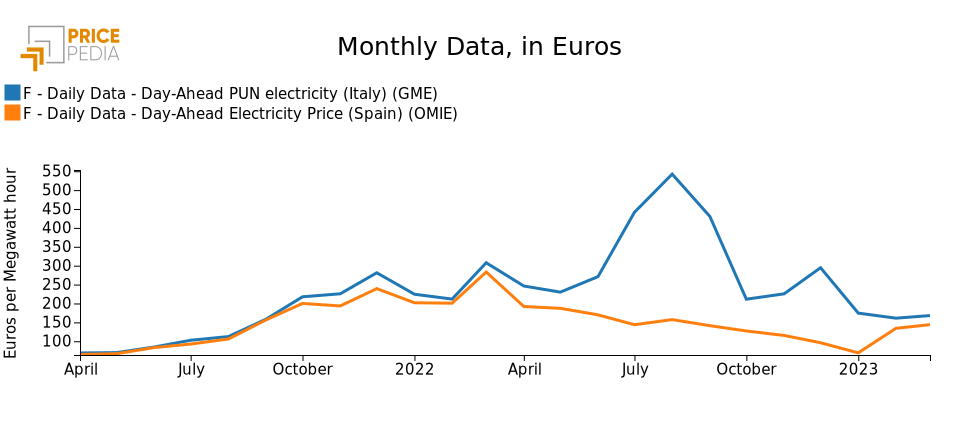

The following graph shows wholesale electricity prices for Italy and Spain for the past two years.

As can be seen from the graph in the period from July 2022 to January 2023, Spanish prices were significantly lower than Italian prices. Italian industry and particularly energy-intensive sectors may therefore have been affected by this higher cost, losing competitiveness to Spanish competitors.

Fig.3 - Electricity prices Italy Spain

Source: ExportPlanning processing.

However, the sectoral analysis only points to the case of Organic Basic Chemistry in which Italy has lost to the European average, indicated a loss of competitiveness to Spain that is more cross-cutting than specific to certain sectors.