A Glance at U.S. Trade in Household Products

Despite favorable overall demand, US exports of household products stagnated due to fierce competition within the segment

Pubblicato da Gloria Zambelli. .

United States of America Trade balance Slowdown Importexport Home items Global demand Global Economic Trends

Accedi con il tuo account per utilizzare le funzioni stampa migliorata (pretty print) e includi articolo (embed).

Non sei ancora registrato?

registrati!

As discussed in several articles1, international flows of products typically intended for household consumption have shown a significant acceleration during the past months. This result is an indirect measure of changes in purchasing behavior imposed by the containment measures. Thanks to a strong rebound in the second half of 2020, global demand for Home product is among the most robust industries during the pandemic year, recording a decrease close to 0.4% YoY. The opening of 2021 confirmed the strengthens of this industry, marking a vigorous 13% increase over Q1-2019 values.

In this context of overall favorable demand, it might be useful to analyze the dynamics of US imports and exports of home products.

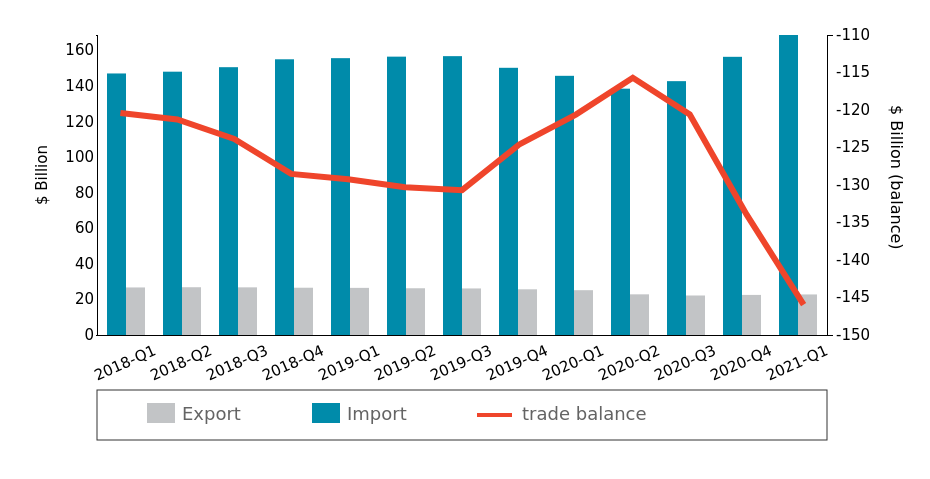

Home products:US Trade Balance

(2018-Q1 to 2021-Q1)

Overall, the United States are a net importer of home products, with imports amounting to over eight times exports, purchasing mainly from China and Mexico. As of September 2019, several household goods, namely Consumer Electronics, Home textiles and Home appliances, imported from China, are affected by Trump's tariff policies, with the aim of boosting American manufacturing production and reduce the trade deficit. As a result (see chart above), in the last three years stagnation in US exports prevails, stable around $ 20 billion, with a fall in imports as of 2019-Q3, due to both protectionist policies and the impact of Covid-19.

In line with the dynamics of global demand described above, after the decline experienced in the first half of 2020, US imports went up in the following months. In the first quarter of 2021 US imports of home products topped the value of 160 billion, worsening the deterioration of the balance of trade and confirming the defeat of the US administration to meet its goal.

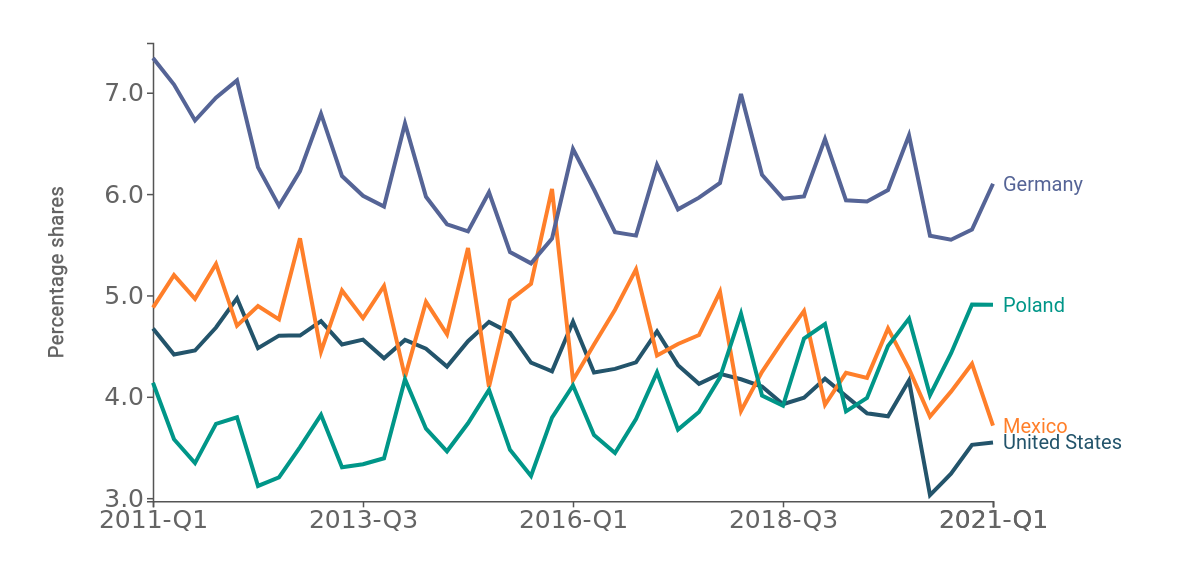

Despite this uninspiring picture, the United States is one of the leading exporters of household products, competing fiercely with Germany, Poland and Mexico.

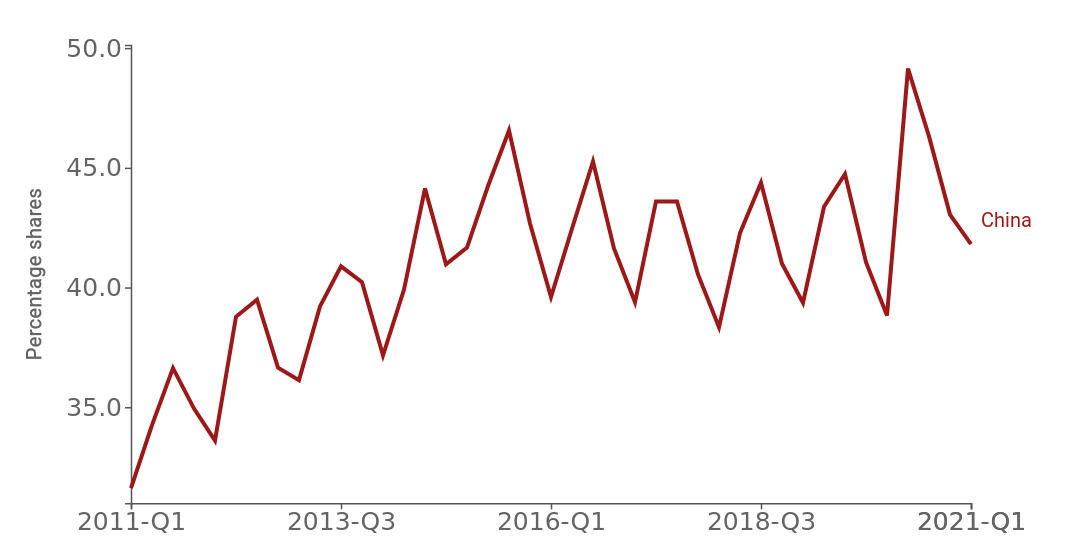

Trend in world Market Share

As can we see in the charts above, over the past decade, China has increasingly established itself as first competitor in this segment, coming to hold almost 50% of the market share in Q1-2020. At much lower levels we find all the other countries, which do not exceed 10% of market share, although Germany's position seems to be slightly more stable than the others.

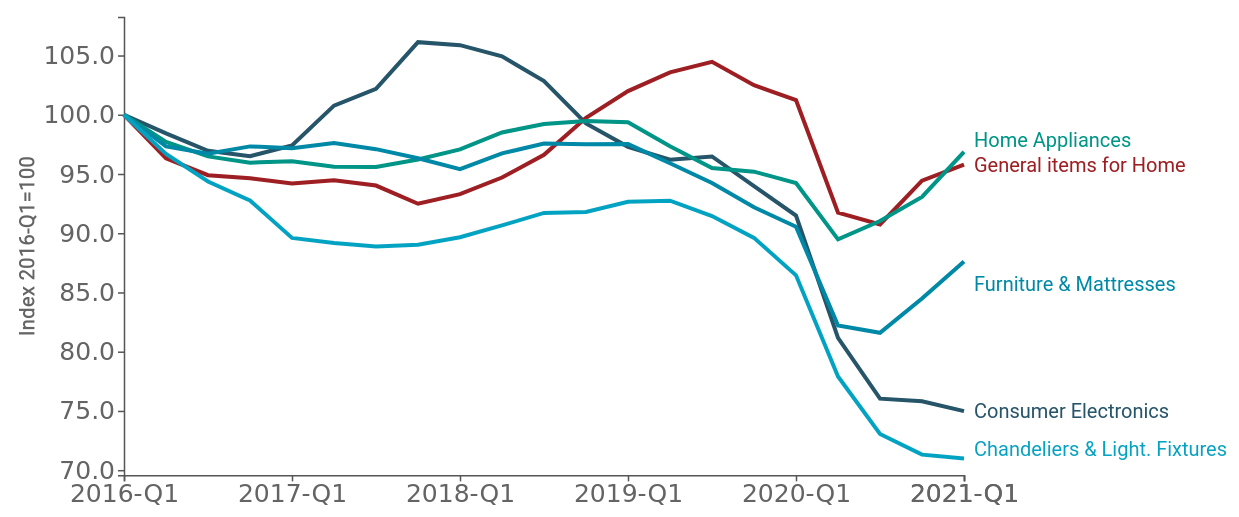

Main home products for US market: the pivotal role of Home Appliances

To understand in which household goods the United States are most competitive, the following graph illustrate the evolution of US exports of the main home products over the last five years, taking the value in 2016-Q1 back to 100.

Main household goods: US Exports (2016-Q1 to 2019-Q1)

Index 2016-Q1=100

Observing chart it is clear that, after a period of heavy decline or stabilization, some products are giving signs of significant recovery approaching the levels of early 2016. Albeit Consumer Electronics are the main home product that the US trades with the rest of the world, constituted about 20% of exports of the total segment in 2020, they might have lost their appeal over the last few years, given the negative trend reversal which brought them to the lowest levels. The same applies to Chandeliers whose decline appears even more drastic compared to Consumer Electronics. In contrast, Home appliances, General Item for Home and Furniture and Mattresses are showing greater resilience,exhibiting a significant upward trend as of Q2-2020.

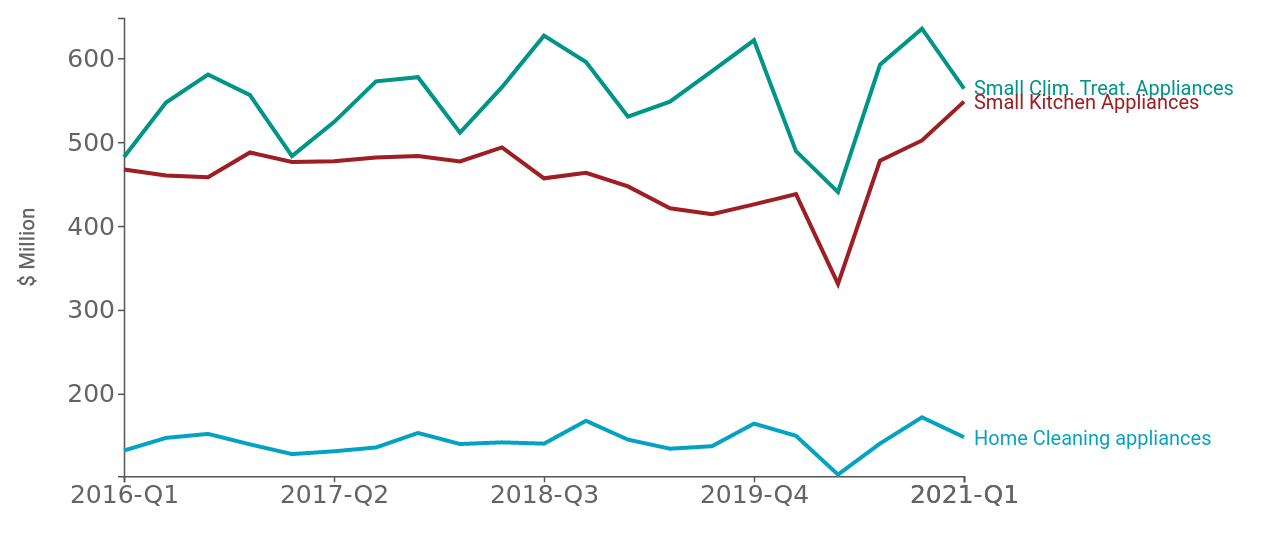

Looking closer home appliances, it is interesting to point out that, the trend observed for US exports of small kitchen products (mixers, fryers, centrifuges, electric and microwave ovens) confirms what has emerged at world level over the last years and which we reported in a previous article: global demand has in fact shown positive and significant growth rates for three years in a row, reflecting a stronger interest of international consumers in improving the kitchen environment (see chart bellow).

US Exports of Electrical Appliances (2016-Q1 to 2019-Q1)

In addition, in the first quarters of 2021 US export of these categories of products grew by 22% in compared to the values of the same period of 2019. As for Small Climate treatment appliances and Home Cleaning appliances, although there is a rebound compared to Q1-2019, respectively by 6% and 2%, the data show a slight decline quarter-by-quarter.

Conclusions

Over the most recent months, the Chinese competitor has confirmed as a particularly successful player in supporting the changing lifestyle and consumption patterns of international shoppers with an adequate supply structure. Although US household products manufacturing are not reaching China's impressive export levels, some products are showing attractive growth prospects driven by current strong global demand.

1. For an in-depth discussion of this topic, see the following articles: Growing Global Demand for Home Appliances and Decor, World Trade Recovery strengthens in Q1-21 and International Trade by Sectors: 2020 Figures.